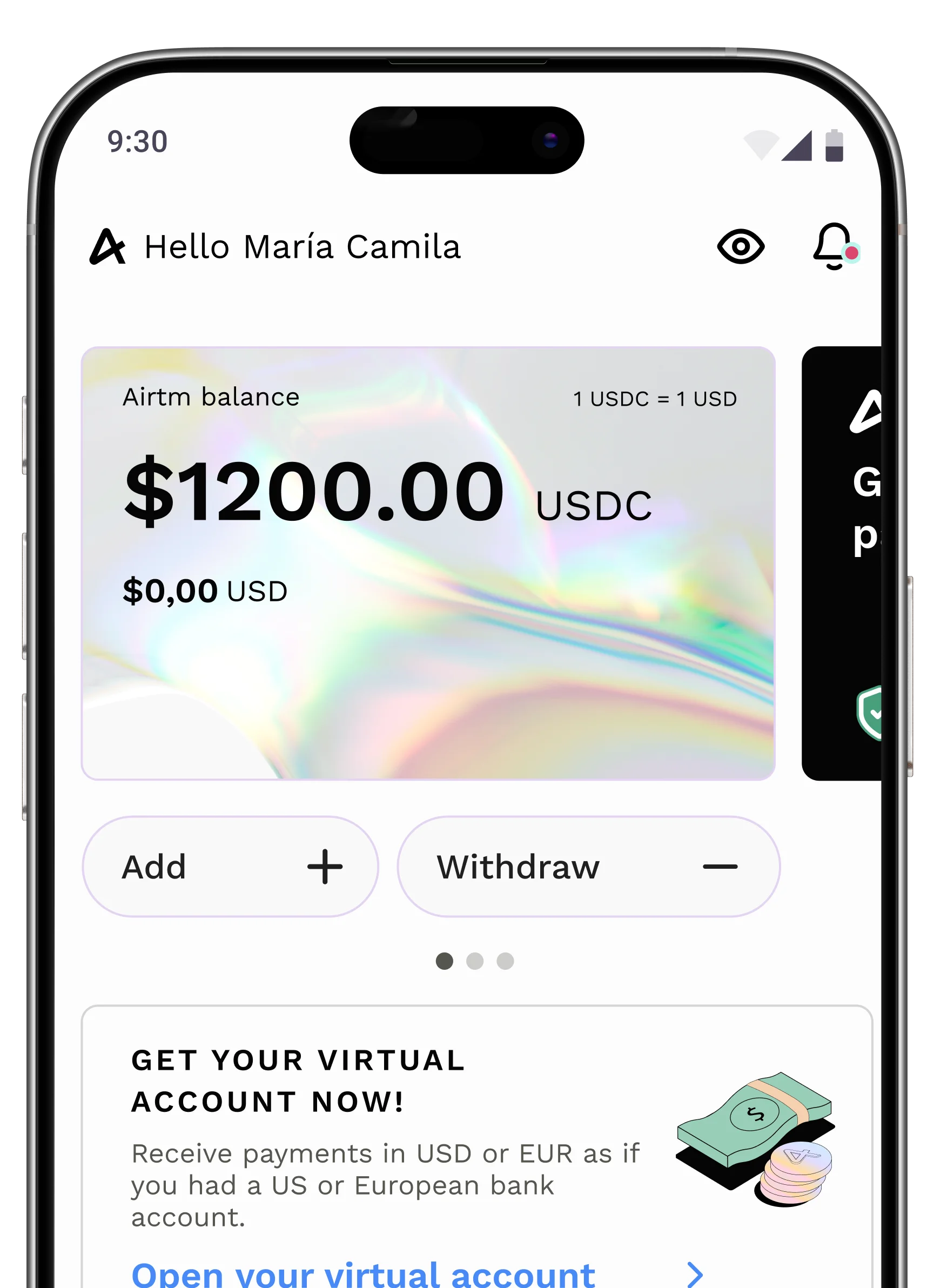

GET PAID BETTER

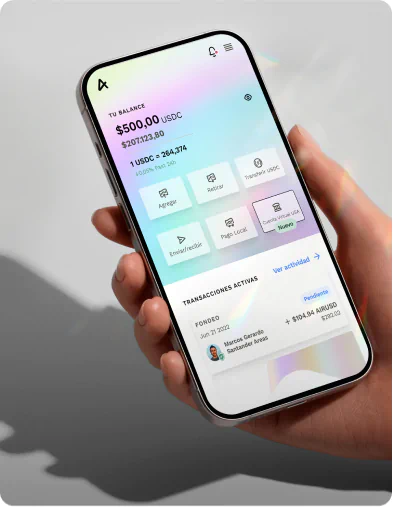

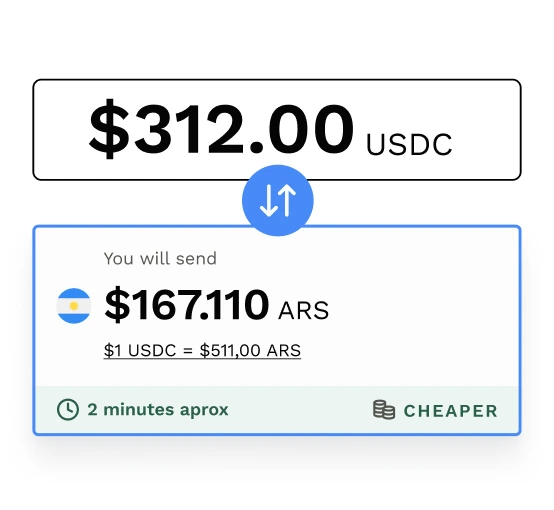

Airtm is the most connected digital wallet in the world, offering an integrated US Virtual Account for non-US citizens, direct withdrawals from partners like Payoneer and access to over 500+ payment methods to convert and withdraw funds to your local currency.

Airtm’s platform delivers rapid cross-border payments, allowing users to cash out earnings in under six minutes or less.

Airtm ensures more of your earnings stay in your pocket, empowering entrepreneurs with efficient, affordable financial services.

Unmatched versatility, supporting over 400 local payment methods and bridging multiple blockchains via USDC.

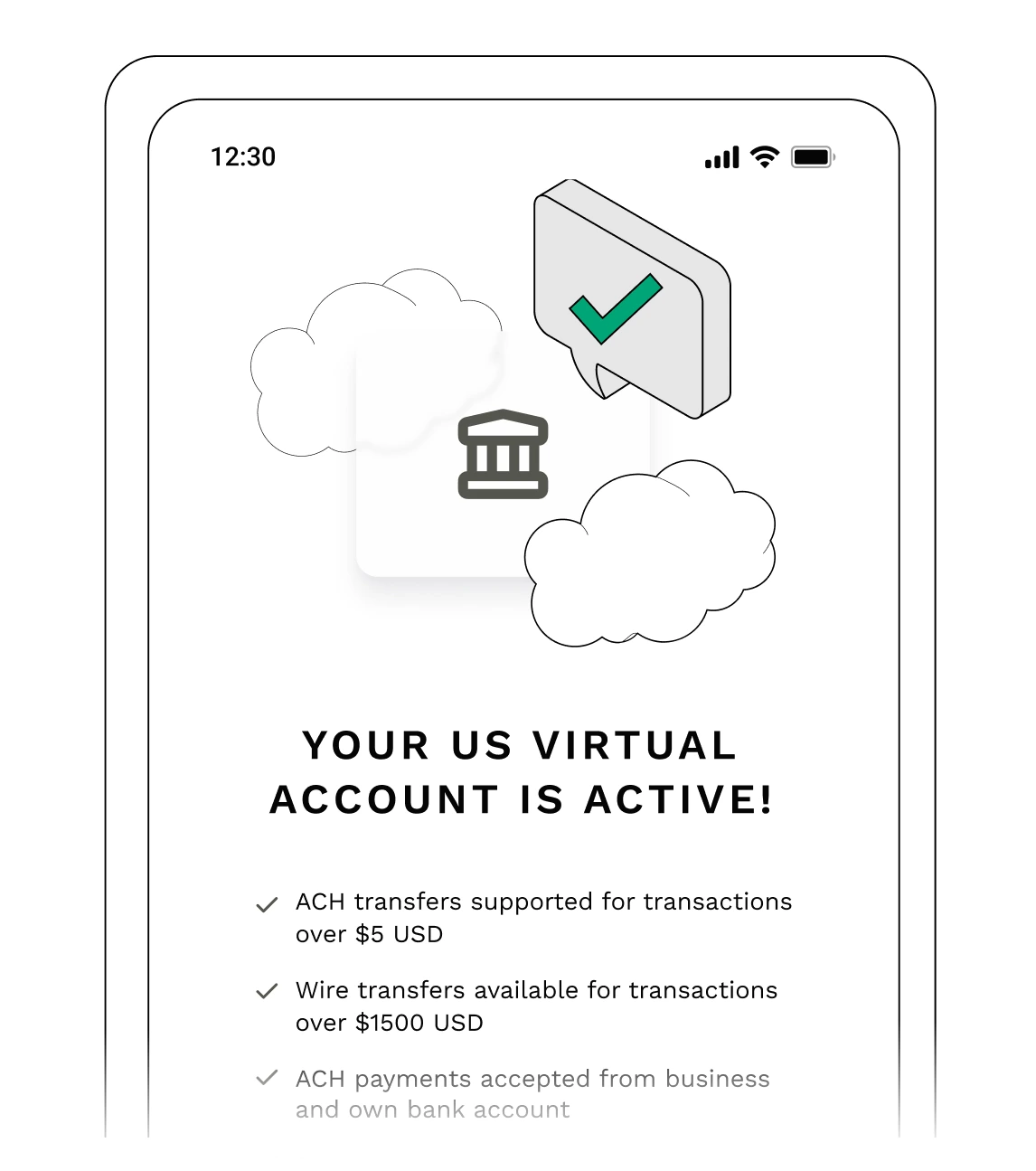

US Virtual Account

Receive payments in USD as if you had a U.S. bank account.

- U.S. banking details (ACH)

- Compatible with banks and global platforms

- Ideal for freelancers, entrepreneurs, and digital professionals

Secure, fast, and borderless.

Discover more details

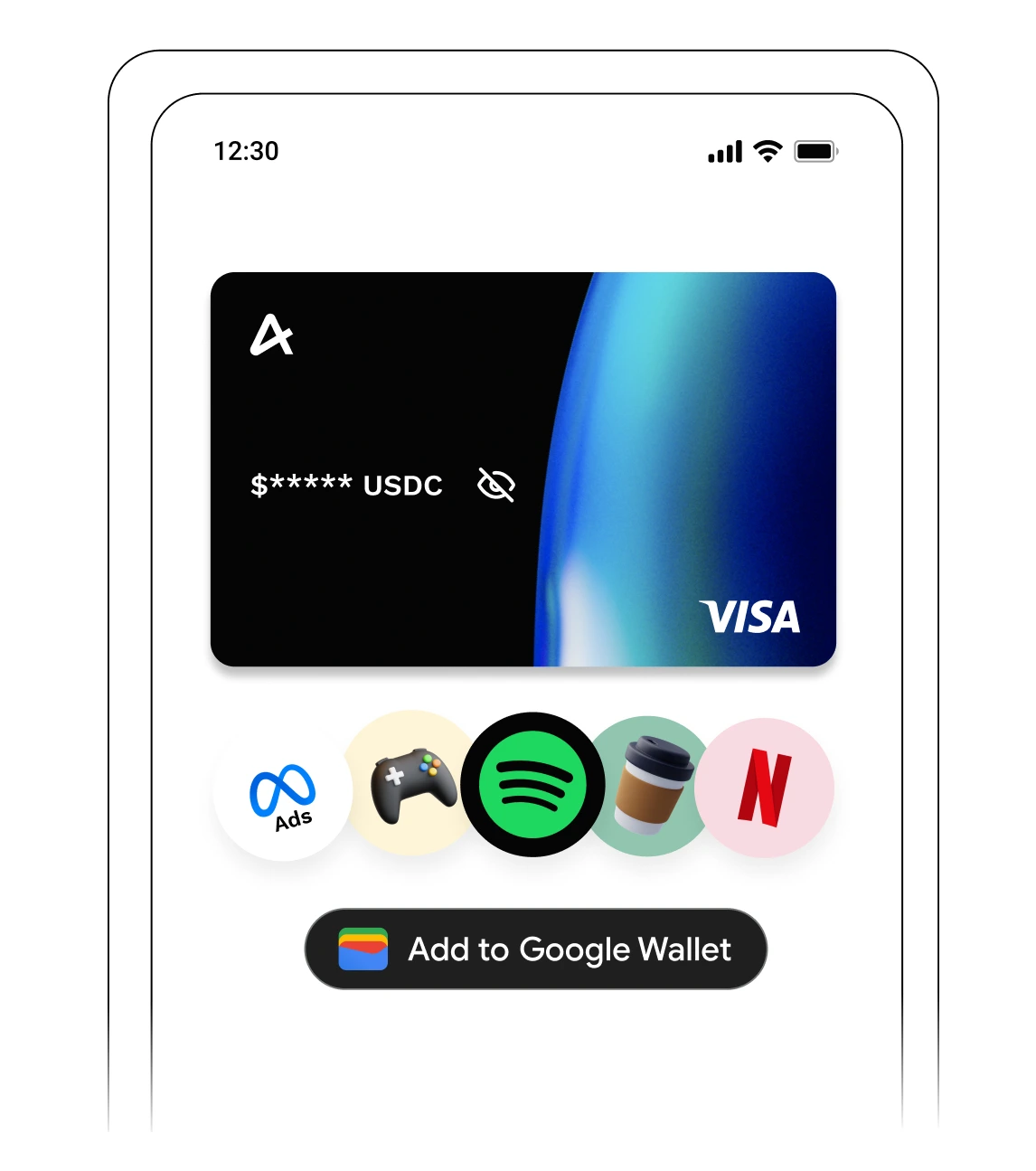

USD Virtual Card

Pay anywhere in the world with your Airtm balance. Get access to a virtual VISA card to make online payments, subscriptions, and use global apps. Top up directly from your Airtm account and add it to Google Wallet or Apple Pay.

- Pay on Spotify, Netflix, Amazon, video games, and more

- Supported by VISA

- Forget about traditional bank accounts

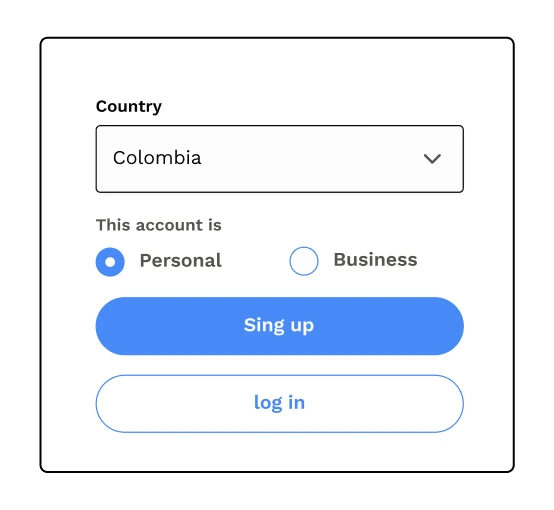

How to join Airtm? It's super easy!

Create your account for free

You'll need your official ID on hand to complete the security verification.

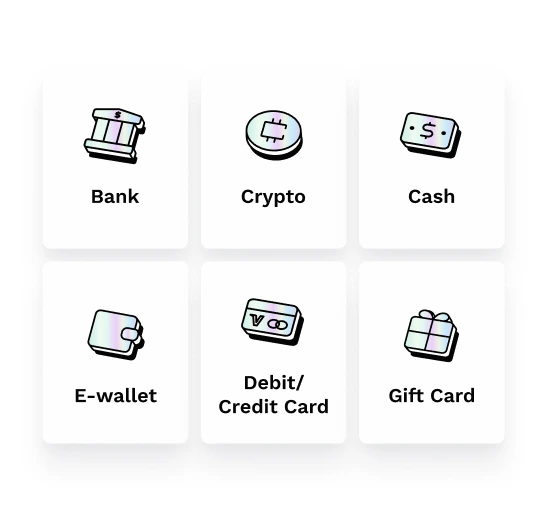

Add funds to your account

We offer over 500 methods to move your money. Use whichever you prefer.

Send, withdraw, or receive money

Move your money wherever you want or receive fast and secure payments.

Receive your Payoneer payments directly in your Airtm account

Thanks to the direct integration, you can withdraw your Payoneer balance to Airtm in minutes. Because you deserve more.

FAQ's

What is Airtm and what is it used for?

Airtm is a digital dollar wallet that allows you to receive, send, convert, and withdraw money in USD from anywhere in the world.

Ideal for freelancers, entrepreneurs, creators, and remote workers who need to get paid in dollars without depending on local banks.

The currency used within Airtm (USDC) is backed 1:1 with the US dollar. USDC is a regulated stablecoin, issued by Circle, an audited company licensed in the US. Each USDC equals one real dollar deposited in US bank accounts or Treasury instruments, offering complete stability and transparency.

Airtm also offers Airtm Business, a solution for companies that need to pay globally in dollars, quickly and securely to their teams or collaborators.

How does Airtm work?

Airtm connects your local money with the digital world. It works as a USDC financial platform that allows you to:

- Receive money in dollars from platforms like PayPal, Upwork, Deel, and many more.

- Convert it to your local currency at the best exchange rate, using the P2P network or direct withdrawals.

- Send or pay in dollars to other users or services, from your Airtm account.

- Spend your USDC balance with the USD Virtual Card (coming soon), compatible with Google Pay and Apple Pay.

All from one account, without needing traditional banks. Airtm is fast, flexible, and made for those who work, sell, or get paid online.

What payment methods are available?

You can use bank accounts, cryptocurrencies, mobile transfers, local wallets, and more, depending on your country. The transaction can be directly with the entity or through our powerful P2P network, covering practically anywhere in the world. Check the available methods within the app or from your account dashboard

Is Airtm a trustworthy company? Where is it registered?

Yes, Airtm is a reliable and legally registered company in the United States under the name Airtm Inc., incorporated in the state of Delaware, with address at 8 The Green, Suite A, Dover, DE 19901, USA.

It is registered with FinCEN (Financial Crimes Enforcement Network) as an MSB (Money Services Business), with registration number 31000205450002.

It has been operating since 2015 and complies with compliance regulations and anti-money laundering prevention (AML/KYC). Airtm works with regulated banking and technology partners, which guarantees a secure environment for your transactions.

In other words, your balance in Airtm represents real value in dollars, with the flexibility to move it in a global digital economy.