Payoneer in Brazil: How to withdraw Brazilian Reals from Payoneer

August, 20, 2025

4 min.

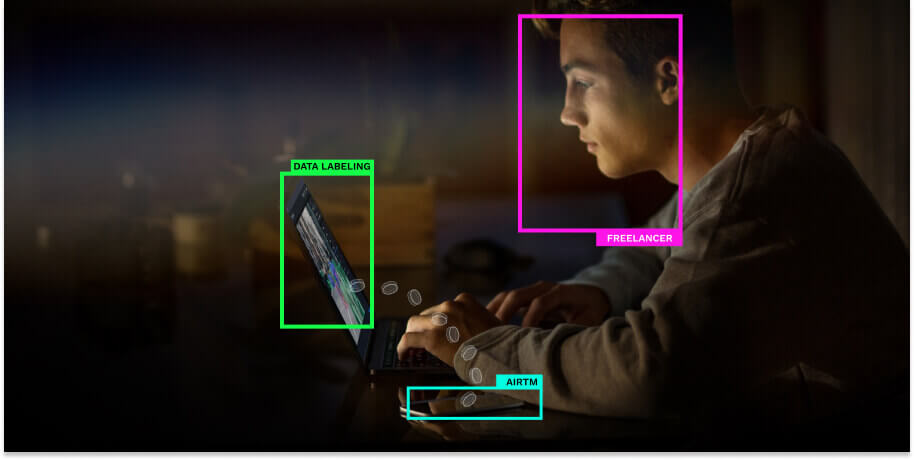

Picture this: you just completed a major project for an international client and the payment landed in your Payoneer account. You’re feeling great, but then you realize you need that money in Brazilian reais to pay your day-to-day expenses. If you’ve been in this situation, you’re not alone. Thousands of Brazilians working in the digital world face this same challenge every month.

Brazil has a vibrant economy and a growing community of freelancers, developers, designers, and digital entrepreneurs receiving international payments. Payoneer has become a popular tool for receiving these payments, but efficiently converting that money to Brazilian reais can be quite a challenge.

The good news is that you have options, and some are much better than others.

Traditional options and their limitations

When you have funds in Payoneer, the most obvious option seems to be withdrawing directly to your Brazilian bank account. Payoneer offers this possibility, but this is where things get complicated. Traditional banks in Brazil usually charge high fees for international transfers, and the exchange rates they offer are rarely the most favorable.

Additionally, depending on your bank, the process can take several business days. When you have bills to pay or simply need quick access to your money, waiting a week isn’t ideal.

Another important point is that many Brazilian banks have limits on incoming international transfers, especially for personal accounts. This can create additional complications if you’re a freelancer receiving regular payments from different clients.

A smarter alternative

This is where Airtm comes in as a solution that truly understands the needs of digital workers. Instead of dealing with traditional banking complications, you can use Airtm as a bridge between your Payoneer account and your Brazilian reais.

The process is quite straightforward. First, you transfer your funds from Payoneer to your Airtm wallet. This is generally done through a P2P transfer, where other Airtm users who need funds in Payoneer exchange with you for digital dollars on the platform.

Once you have the funds in Airtm, you can convert them to Brazilian reais and withdraw them through multiple methods: bank transfer, Pix, and even other digital wallets popular in Brazil.

The real advantages of this approach

What makes this solution special is the speed and flexibility. While a traditional bank transfer from Payoneer can take a week, with Airtm you can have access to your reais in a matter of hours or, at most, a couple of days.

Exchange rates also tend to be more competitive. Airtm operates with real market rates, not the inflated rates that some traditional banks handle for international transfers.

But perhaps most importantly is the control. With Airtm, you can choose when to make the currency exchange. If you see that the real is strong against the dollar, you can wait for a more favorable moment. This flexibility is especially valuable in a country like Brazil, where monetary fluctuations can be significant.

Practical tips to maximize your withdrawals

If you decide to use this strategy, there are some tips that can help you get the most out of it. First, stay aware of exchange rates. You don’t need to be a forex expert, but having a general idea of trends can help you decide when it’s a good time to exchange your dollars for reais.

Also consider making transfers in larger batches when possible. Although Airtm’s fees are reasonable, it’s always more efficient to move larger amounts occasionally rather than making many small transfers.

Always maintain some liquidity in different currencies. Brazil has experienced inflation and monetary volatility, so having part of your savings in dollars can be a smart protection strategy.

Navigating the financial future with confidence

The world of work is changing rapidly. More and more Brazilians are finding incredible opportunities working with international clients, but this also means navigating a more complex financial landscape.

Don’t let traditional banking complications limit your potential. With tools like Airtm, you can take complete control of your money, move it when you need it and how you need it, and focus on what really matters: growing your career and your income.

The future belongs to those who embrace financial flexibility. Your money should work for you, move with you, and be available when you need it. With the right combination of digital tools, you can turn the challenges of international payments into competitive advantages.