6 Digital Payment Trends to Watch in 2025 (+ Expert Insights)

June, 19, 2025

3min.

The way global businesses pay out money is changing fast in 2025.

Wire transfers are burning. Hidden fees are exposed. And businesses are ditching banks in real time.

Global payouts are faster, cheaper, and fairer than ever before. Here are the top payment trends driving the shift and what it means for how companies pay their people in 2025.

- Trend 1: Stablecoins used to be “nice to know.” Now they’re need to use.

- Trend 2: Hidden fees are finally getting called out.

- Why do you think connectivity is important for small to medium-sized businesses?

- Trend 3: Mobile wallets are going corporate.

- Trend 4: Traditional payments players are getting sidelined.

- Trend 5: Real-time global settlement is becoming the new standard.

- Trend 6: Faster payments are fueling fairer pay.

- 🔚 Where Global Payments are All Headed

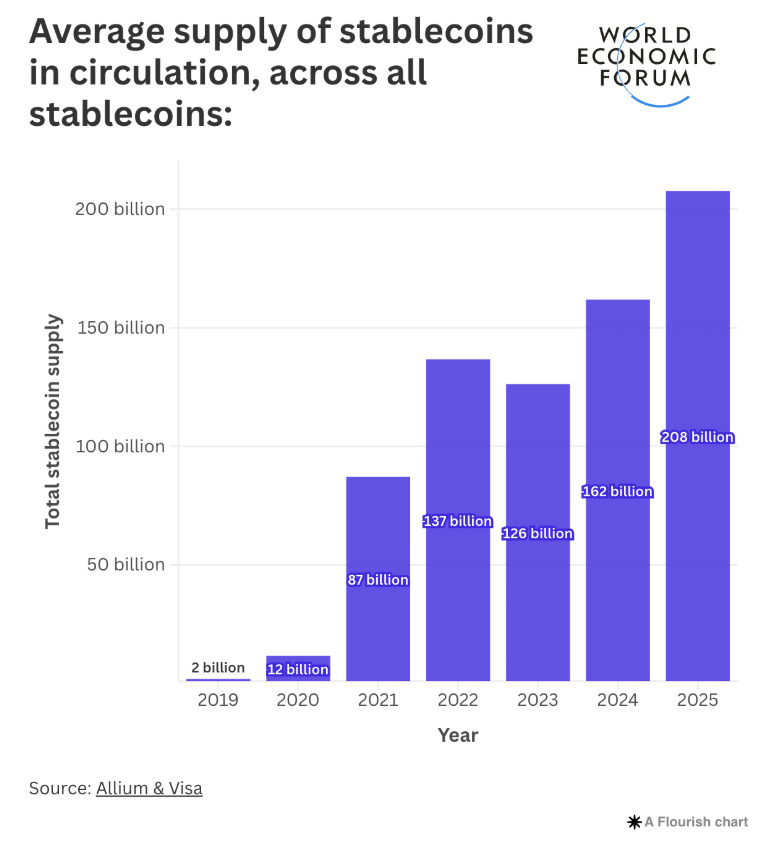

Trend 1: Stablecoins used to be “nice to know.” Now they’re need to use.

Stablecoins like USDC are no longer fringe tech. In 2024, they moved over $27.6 trillion, surpassing the combined volume of Visa and Mastercard transactions. Now in 2025, they’re a go-to rail for global business payments.

The number of active wallets jumped 53% in a year, all clear signs that enterprises are moving beyond test cases into real-world adoption.

Businesses are adopting stablecoins for various reasons:

- Cross-border payouts happen in minutes, not days, and without the cost of correspondent banks or FX markups.

- Treasury operations gain real-time control, enabling instant intercompany transfers, vendor payments, and liquidity management.

- Vendor invoices can be settled with stablecoins like USDC or even custom enterprise tokens, cutting fees, speeding up reconciliation, and unlocking new revenue models.

What’s fueling this shift?

The core driver is design. Stablecoins are built for speed, transparency, and lower costs. They remove the need for correspondent banks, eliminate delays, and reduce foreign exchange markups.

Regulation is also helping adoption. Europe’s MiCA framework went live in late 2024, bringing licensing, reserve requirements, and transparency to the stablecoin space. Circle’s USDC has already been approved under MiCA, giving businesses greater confidence in compliance and stability.

In the U.S., regulators are softening toward bank involvement with stablecoins, while draft laws aim to formalize oversight. Enterprises favor regulated, fully backed stablecoins like USDC for risk management.

Enterprise systems are adapting too. ERP (Enterprise Resource Planning) systems now embed stablecoins, bypassing wires entirely and giving finance teams real-time control over intercompany transfers, vendor payments, and treasury flows.

Stablecoins are also challenging FX and trade finance norms.

Businesses can now hold stablecoin balances in multiple currencies, swap them instantly, and reduce the need for costly foreign accounts or bank wires. This is especially valuable for global SMEs who often lack access to competitive FX rates or fast settlement rails.

💡 The takeaway: With safeguards, many enterprises view the opportunities (faster, cheaper, programmable payments) as outweighing the challenges. Stablecoins are poised to become a standard component of the B2B payments toolkit, especially for cross-border commerce and large-value transactions where legacy systems have been least efficient.

What’s the biggest misconception businesses still have about using stablecoins?

“The biggest misconception businesses have about stablecoins is that they’re too complex to understand—that you need deep blockchain expertise to even get started. But in reality, the technology is simple, and using it doesn’t require becoming a crypto expert.

What’s really missing are more case studies and real examples of how legitimate companies are using stablecoins today. A lot of teams also assume it’ll make their payout process more complicated, when really, it can solve problems—speed, access, inflation, cost, control. But because they don’t fundamentally understand how stablecoins work, they don’t see the bigger picture or the value it can bring to their user communities or workforce.”

–John Schauf, Director of Community & Payment Services @ Airtm

Trend 2: Hidden fees are finally getting called out.

For years, international payments have quietly bled money through opaque FX markups and buried bank fees. Many providers still obscure the real price of payouts.

For example, in many countries, payouts are sent in USD, EUR, or GBP, even if the recipient’s address is in a different country. The local bank converts it, often at a bad rate, and adds a fee. Users can’t control the timing either, so if it hits on a Friday, they’re stuck with that rate until the markets reopen.

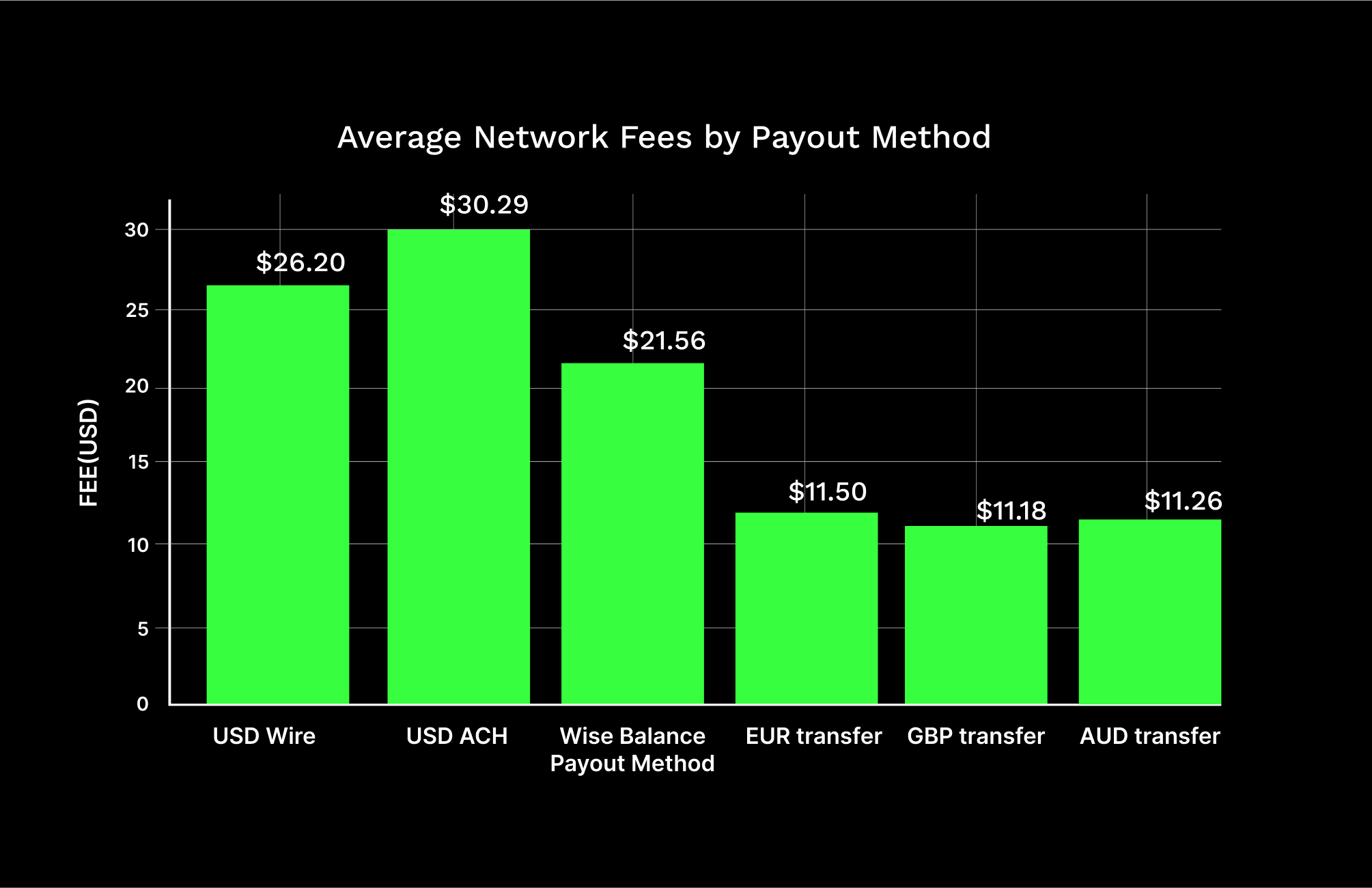

Average network fees charged by leading fiat wallet providers by payout method (country-dependent).

These fees are added on top of any company-specific incoming, payout or conversion costs.

In 2023, U.S. businesses and consumers lost $5.8B to hidden currency conversion costs alone. In 2025, regulatory bodies are taking action.

- In the United States, the Consumer Financial Protection Bureau introduced measures to crack down on misleading pricing in international transfers.

- In the European Union, transparency rules and fee caps are already in place.

- Globally, the G20 is pushing for more open and affordable cross-border payment systems.

Smart contracts are also being used to automate payouts. When built into blockchain platforms, these contracts execute payments when agreed-upon conditions are met.

💡 The takeaway: In 2025, reducing hidden fees is becoming a baseline expectation. Businesses that meet this standard are better positioned to attract talent, expand globally, and retain the trust of their customers.

Why do you think connectivity is important for small to medium-sized businesses?

“The biggest reason I think it matters is if we can do everything in one transaction, one trip, why not? For example, I get paid through a chain of “Big” money transfer providers and finally to my bank. By the end of that mess, I’ve lost about $200 for no reason. That’s why I always talk about Airtm. With all the cash-out and withdrawal options, it gives people actual choice.

What I love is that freelancers, workers, employees, whoever, they can decide what to do with their money. When I was working in Canada, I’d get a paycheck and that was that. But with Airtm, you get your paycheck and then choose: send it to your bank, drop it in your crypto wallet, move it to another virtual wallet.

Also, in some regions, banking systems just aren’t ideal. People want to keep their money in virtual wallets. Airtm makes that easy. That’s the real selling point I share with clients: every worker gets their own wallet. You’re paying them, sure, but they’re in control. If they’re in a volatile market, they can preserve more of their earnings by keeping their money in a digital wallet like Airtm, instead of their money losing value if it goes straight to their bank. It lands where they want it to.

–Samuel Playford, Enterprise Account Executive & Inbound Sales Manager @ Airtm

Trend 3: Mobile wallets are going corporate.

Once used to buy coffee, mobile wallets are now used to run companies. What started as a consumer convenience has become a serious tool for procurement, vendor payments, reimbursements, and even cross-border transactions. Businesses are embracing mobile wallets because they’re simple, fast, and already in everyone’s pocket.

But in receiving payments, speed matters.

More companies are equipping teams with mobile wallets to make instant purchases on the go.

Digital workers and vendors are getting paid faster and when payments are reliable, they’re more likely to keep working with you.

In regions like Sub-Saharan Africa, mobile wallets have become the de facto financial infrastructure, with mobile money payments topping $1 trillion in 2022.

Platforms like Airtm handle everything from customer orders to supply-chain payouts. When a digital worker receives funds instantly to their wallet, there’s no chasing down wires or wondering when a payment will land.

💡 The takeaway: Mobile wallets are the new baseline for paying fast, staying flexible, and keeping your teams (and vendors) happy.

Want the tactics top AI & BPO platforms use to keep contributors loyal? Get the newsletter.

Trend 4: Traditional payments players are getting sidelined.

Businesses can now send stablecoins wallet-to-wallet, or settle in local currencies using fintech rails, without waiting days or paying layers of fees. This disintermediation is putting pressure on legacy institutions.

Wire transfers and foreign exchange services, once core fee revenue sources, are losing ground to faster, cheaper alternatives. But while some providers are falling behind, others are adapting.

Some are adapting:

- Visa is piloting USDC settlement.

- JPMorgan runs Kinexys for internal transfers.

- Banks are quietly adding stablecoin custody and services.

💡 The takeaway: The future of payments isn’t waiting for banks to catch up. Businesses are moving money faster and cheaper, with or without them.

Trend 5: Real-time global settlement is becoming the new standard.

Across the world, domestic instant payment systems have gone live or are nearing launch—like RTP in the U.S., Faster Payments in the UK, and UPI in India. At the same time, stablecoins are filling the gap across borders, enabling businesses to send funds globally with the same speed and certainty.

Instead of holding money in transit or parked for days waiting to clear, companies can keep funds earning interest until they’re needed. That’s better liquidity, tighter cash flow control, and less reliance on working capital buffers. For example, a company in Brazil can pay a contractor in Kenya or a vendor in Colombia, and the funds land in seconds.

💡 The takeaway: Financial systems that used to move at the pace of paperwork are now operating at the speed of software. Businesses embracing that speed are already seeing the upside.

Trend 6: Faster payments are fueling fairer pay.

Real-time payroll signals that a company respects the value of someone’s time and work.

The dynamic changes when digital workers, especially those in gig, contract, or remote roles, can access their earnings without delay.

Mobile wallets are making that possible.

By eliminating banks and slashing administrative overhead, businesses can lower the cost of paying people and, in some cases, redirect those savings into better compensation or more flexible payout options.

Speed is good. Access for all is better.

Direct wallet payouts unlock income in places where traditional banking has failed. In many emerging markets, contributors can now receive payments instantly, even without a formal bank account. That makes digital work viable for a wider talent pool.

And it’s more transparent.

With digital wallets, both sides get real-time visibility. Workers see exactly when a payment is sent and received. Employers see exactly when funds are delivered. This clarity helps reduce disputes, delays, and tension.

Fast pay boosts participation, too.

For micropay for microtasks (small pay for short tasks), speed makes or breaks motivation. It’s not worth labeling 50 images for $3 if you have to wait a week and pay fees to access it. But when the reward is instant, the work feels worth it.

Companies like Sapien are already implementing this. By replacing multiple payout systems with Airtm’s unified platform, Sapien eliminated the need for manual transfers, currency conversions, and country-specific workarounds, cutting costs and reducing payout delays. Contributors in even the hardest-to-reach regions get paid faster, with fewer fees and no uncertainty.

What usually brings companies to Airtm in the first place?

“Often, companies come to us because they’re struggling to pay people in certain countries. They need a payment method that actually works in those regions—something that can adapt to their specific challenges. That’s where Airtm stands out.

A lot of competitors offer a one-size-fits-all model. It’s up to the company to figure out the details, which can be time-consuming and expensive. With us, it’s different. Sure, we have API documentation like everyone else, but we don’t just hand it over and wish you luck. We assign people to help you through the process, customize it to your needs, and support you from a resource standpoint. We work alongside you.

That’s the core difference. We’re not just selling a boxed product and walking away, we’re actually partnering with you to make it work.”

–John Schauf, Director of Community & Payment Services @ Airtm

🔚 Where Global Payments are All Headed

Taken together, these six trends point to one clear direction: the future of payments is faster, more transparent, and fairer by default.

From stablecoins and mobile wallets to the disintermediation of legacy players, businesses are no longer waiting for old systems to catch up. They’re moving toward real-time, global-ready payment solutions that put more money into the hands of those who earn it, without unnecessary delays.

In 2025, the companies leading the way are the ones that:

- Pay in minutes, not days, or even months.

- Make costs and conversions transparent.

- See fair pay not as a cost, but as a competitive advantage.

At Airtm, we believe better payment practices don’t just solve technical problems—they strengthen relationships, unlock opportunity, and create a more equitable global economy.

That’s the direction we’re building toward. And we’re just getting started.

If this resonated, our newsletter will too. Get stories, tips, and updates that put digital workers first.